Private Markets Investment

Management Company

TARGET INVESTMENTS

Capital & Funding

- By combining regional reach, local networks and deep industry expertise across private markets, we engage with industry leaders and entrepreneurs in all key markets to proactively source attractive investment opportunities for our clients.

- We focus on high-quality assets in the extended middle market that isstill in the growth phase of their development. As a long-term investors, we work with the companies and assets we invest in to grow their business through expansion projects and operational improvements.

Accessing private markets opportunities

- Access to private markets investments has traditionally been constrained by high minimum commitment amounts and a lack of liquidity during the holding period, making it difficult for private investors to invest. As a result, it is largely institutional investors who have been able to benefit from the attractive return profile and diversification benefits provided by private markets asset classes to date.

- Asyaf Investments has developed a range of private market investment solutions that are available for private individuals and overcome these high barriers to entry.

Investing in private markets

- We invest in private assets, held outside capital markets. Our focus is on investing in high-quality companies, real assets or infrastructure assets and on creating value in our investments through active, long-term and responsible ownership.

- We generate growth during our holding period by actively working with management teams to improve the performance and strategic direction of a company or asset, carry out operational improvements and source complementary acquisitions. Our investment holding period typically lasts seven to ten years.

- Throughout this period, there is a strong alignment of interest between you as an equity owner and us as the management team, as we are both focused on maintaining sustainable value creation and a stable ownership structure.

- Once our value creation objectives have been achieved at the end of the holding period, we aim to realize returns for our investors by selling our interest in the company or asset.

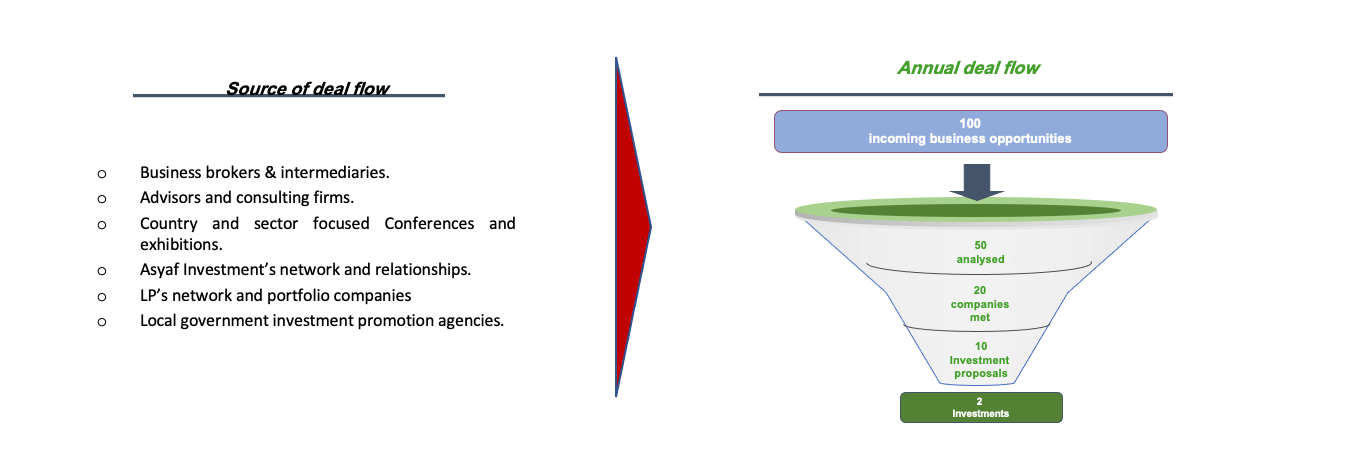

Deal Origination

Investment criteria

Asyaf Investments invests in established companies with a solid business model, sustainable market position and strong management team. Other important criteria relate to cash flow generation and international presence or development potential.

Investment opportunities are assessed based on the following five criteria:

- Solid business model: The presence of a solid business model is a key element for each investment. The company’s leadership position needs to be derived from a real competitive advantage that is strong and sustainable. In this case, the main keys for unlocking further value creation are in the hands of the company. Likewise, the development will not be primarily dependent upon market conditions but will be driven by internal initiatives or specific opportunities. Sustainable competitive advantage can be derived from barriers to entry, unique technology, dominant market share or state-of-the-art operations.

- Growth perspectives: We seek to invest in companies with clear and sustainable growth perspectives, over and above market growth. Asyaf Investments hence prefers investment returns to be primarily based on the increase of sales and cash flow rather than on pure deleveraging and financial engineering. Furthermore, we believe that growth fuels corporate development and can counterbalance the impact of a cyclical downturn in the overall market.

- Capacity to generate cash flow: The capacity of a company to convert sales into free cash flow is a third important investment criterion for Asyaf Investments. It allows the company to further invest in the growth and strategic development of its business and/or to distribute dividends regularly.

- Strong management and governance: Asyaf Investments invests in companies led by strong management teams displaying strategic vision, dedication and inspirational leadership. We encourage the implementation of long-term incentive plans that align the interests of management and shareholders.

- Regional presence: We find that many companies matching each of the above investment criteria also have a regional footprint. Whilst not a prerequisite as such, their exposure to different geographical markets provides credibility to growth forecasts, diversifies market risk and can often be considered a good indicator of business model strength.