Private Markets Investment

Management Company

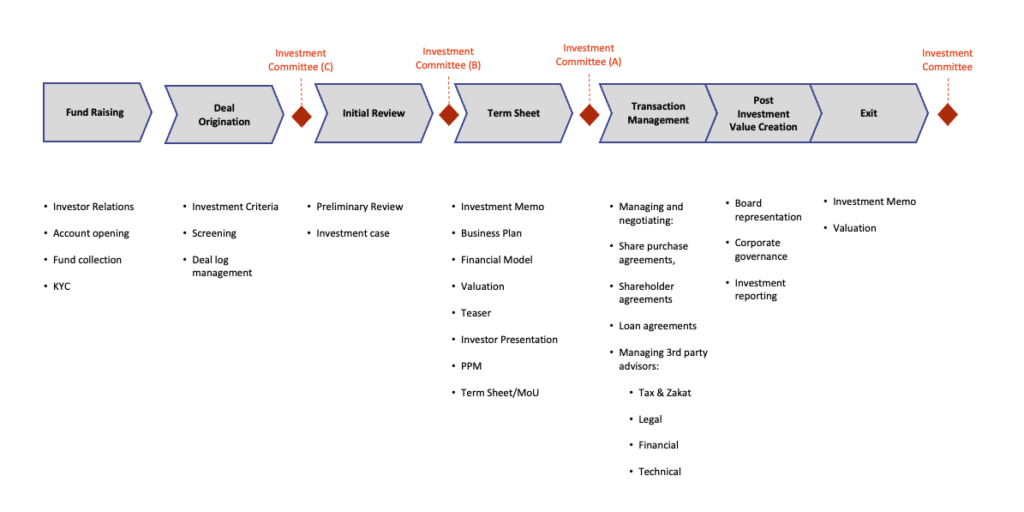

Investment Process

The in-depth process of Private Equity investment requires foresight, perspective and rigorous attention to detail. At Asyaf Investments we have our finger on the pulse, every step of the way.

01

Project Identification

Executive summaries received by Asyaf Investments describe the business, the market in which it operates, the competitive nature of that market, and the value of the provided service or product. Summaries outline also expected market growth, and the present and forecasted growth status of the business.

Looks into operations to be completed, the firm’s financial data from the last five years, the shareholder structure and the professional experience of the managerial/directorial team. Analysis and discussions with an internal committee follow to determine how the project would fit with the portfolio.

02

Investment Analysis

Successful projects are subjected to deeper analysis with emphasis on alignment among shareholders, the capability of the management team to deploy the development plan, target market drivers and dynamics, business model, competitive market positioning and potential for growth and value creation.

This analysis includes the following phases:

- First round meetings allow a deeper understanding of the company, alignment among potential future partners, key terms and conditions of the potential investment, and identify potential conflicts that could threaten the investment during the investment period.

- An in-depth due diligence analysis of the enterprise’s financial model includes a projected 5-year business plan, ESG considerations, meetings with directors and strategic plan development.

- Negotiations commence for the capital investment in the company.

03

Decision to Invest

Positive findings lead to the drafting of an investment agreement, determining entry, continuance and exit conditions. The company is valued by the management team and the two parties agreed upon the contributions to be made and the percentage share of the business to be acquired.

04

Value Creation

We strive to generate value through our guiding presence in governing bodies, our wide network of national and international contacts, financial support, improved commercial exposure, protection of shareholder interests, preferential access to investing communities and constant coaching and support in strategic decisions related to recruitments, business models, negotiations, etc.

05

Divestment Process

All Private investment funds have a defined timeline with the eventual goal being the return of investment to investors. The exit point is normally agreed upon at the point of entry and may include repurchase of the stake by the company, sale to other shareholders or to secondary or third parties, or an IPO (initial public offering in which the firm becomes a publicly traded company).